One of the most important (and often overlooked) parts of choosing personal insurance is how your premiums are structured.

And as an adviser, one of my favourite things to explain is level premiums, mainly because most people don’t even know they’re an option. Let’s break it down:

Stepped Premiums (aka Rate-for-Age)

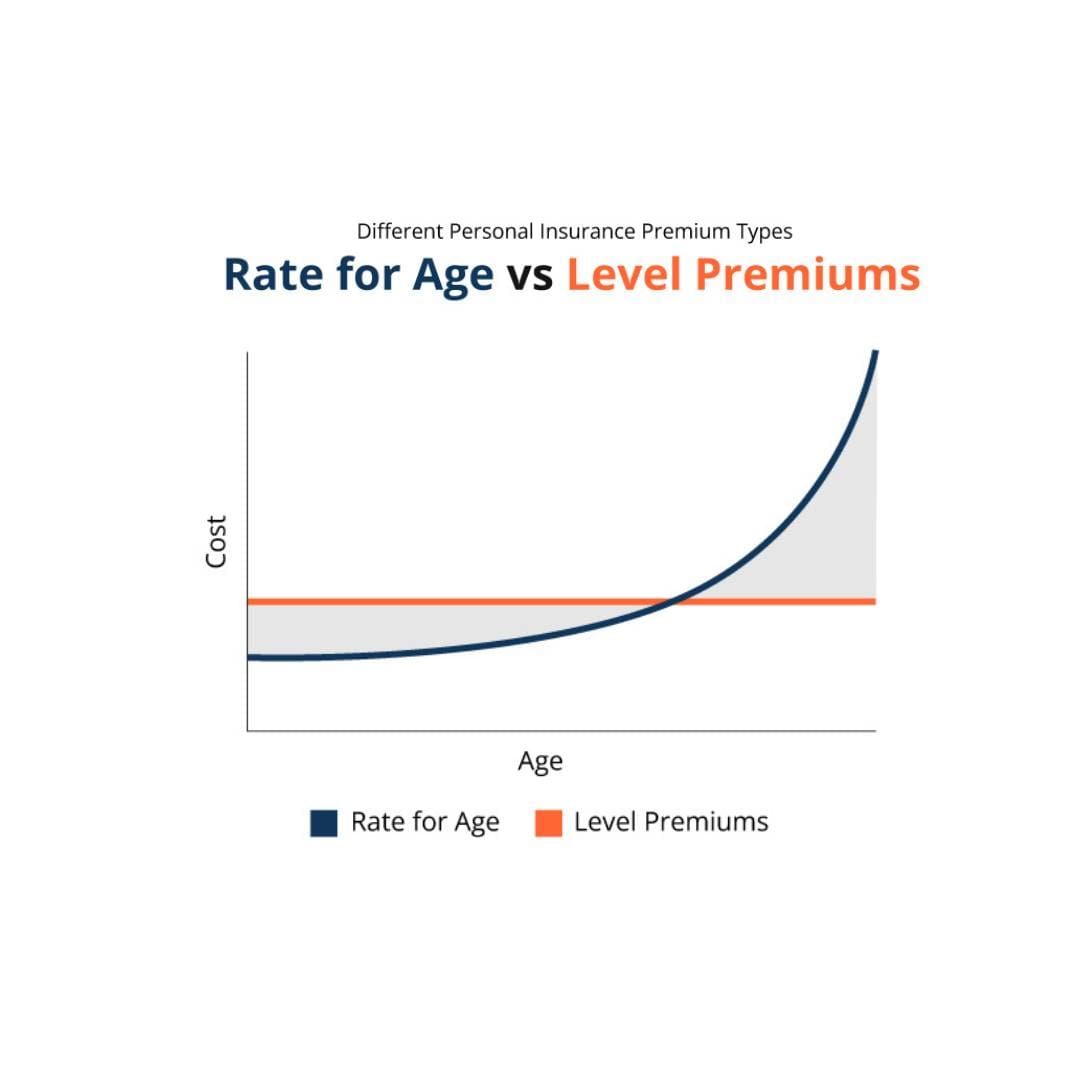

With stepped premiums, your payments start off lower but increase as you get older. This is because the risk to the insurer increases with age, so your premiums are recalculated annually.

It might seem affordable now, but by the time you reach your 50s or 60s, these premiums can become expensive, often to the point where people feel forced to cancel their cover.

Level Premiums

Level premiums work differently. You pay a higher premium at the start, but that amount stays the same for the life of the policy (usually up to a set age, such as 70 or 80). This structure smooths out your costs over time and helps avoid the premium spikes that come with age and often when you need the cover the most.

While it can cost more in the early years, level premiums often work out to be more cost-effective in the long run, especially if you take out cover while you’re still young and healthy.

Why It Matters

Too often, people cancel their policies later in life because stepped premiums become unaffordable just when they’re statistically more likely to need the cover.

Level premiums offer a way to avoid this scenario by locking in a stable cost from the outset.

Can You Combine Both?

Yes, you can mix and match. Many people choose a combination of stepped and level premiums to suit both their short-term budget and long-term needs.

If you’re unsure which option is right for your life or trauma cover, I can help you review your current structure and run a comparison. It’s all about finding a balance that works for your stage of life, budget, and future goals.

www.dianamcintyre.co.nz

021888090